How to Calculate Crane Total Cost of Ownership (TCO)

A Practical Decision Guide for Industrial Projects in the Middle East, Southeast Asia, and Central Asia

In the Middle East, Southeast Asia, and Central Asia, cranes are not auxiliary equipment. They are core production assets that directly determine project schedules, operational costs, and delivery reliability.

Projects in these regions often face:

High temperatures, dust, or high humidity

Long operating hours and high working cycles

Tight schedules with extremely low tolerance for downtime

Because of this, experienced engineering and procurement teams share a clear understanding:

A low purchase price does not mean a low total cost.

What truly determines project success is not the initial investment, but the crane’s Total Cost of Ownership (TCO) throughout its service life.

For infrastructure, railway, port, steel, shipbuilding, automotive, aerospace, and industrial manufacturing projects, calculating TCO before signing a contract is far more important than fixing problems after installation.

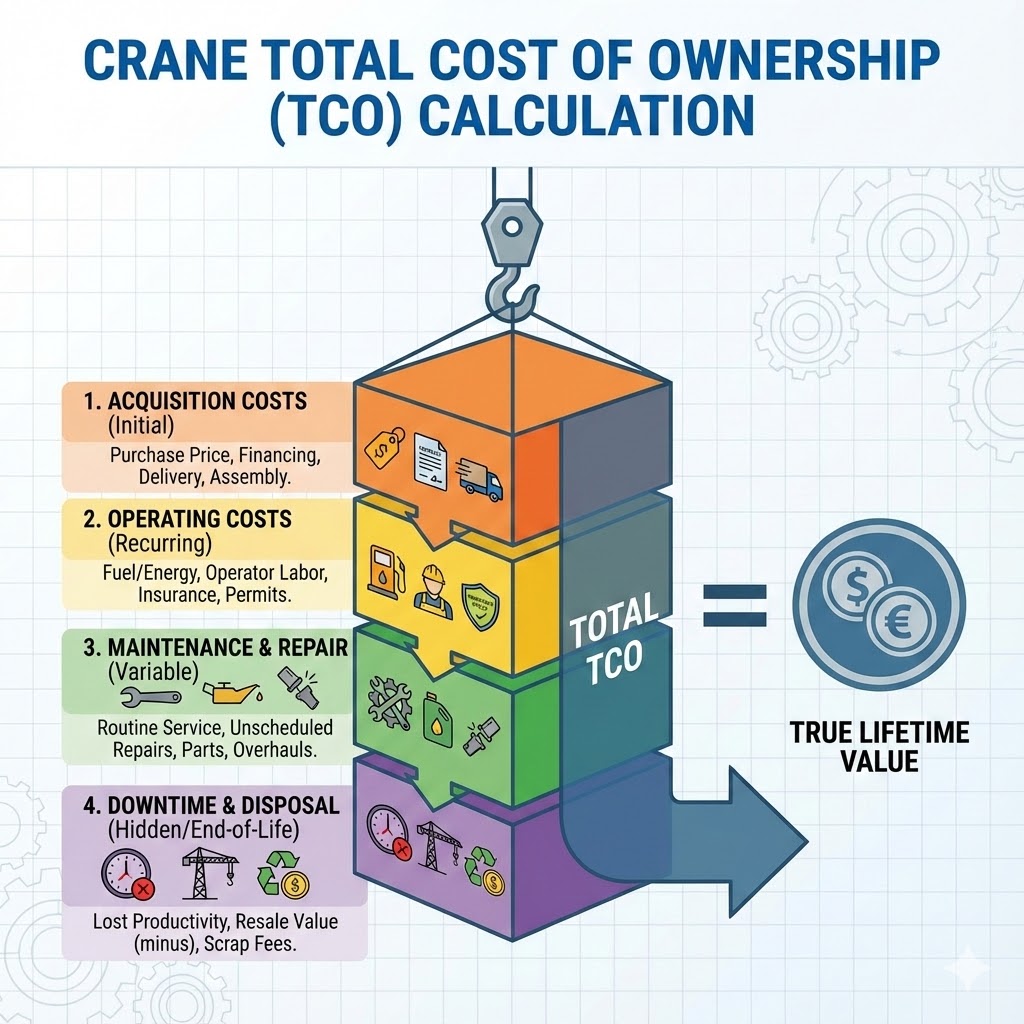

What Is Crane Total Cost of Ownership?

Crane TCO represents all real costs incurred from purchase to retirement, including:

Equipment purchase cost

Installation and commissioning

Energy consumption during operation

Maintenance and repair expenses

Downtime-related productivity losses

Service life and residual value

In real project scenarios, it is common to see that:

The purchase price accounts for only 30–40% of the total crane lifecycle cost.

The remaining 60–70% occurs after the crane has already been installed and put into service.

6 Key Factors That Determine Crane TCO

1. Initial Purchase Cost: Low Price Does Not Mean Low Cost

Purchase price is the most visible number, but also the most misleading one.

Key questions that matter more than price include:

Has the structural design been validated under long-term working conditions?

Is the configuration optimized for high temperature, dust, or humid environments?

Is the crane designed for continuous operation, or merely rated to “meet parameters”?

In high-intensity projects, incorrect crane selection often leads to years of additional operating costs.

2. Installation and Commissioning Cost: Time Is an Invisible Expense

In Middle Eastern and Central Asian projects, one fact is often underestimated:

The longer the installation period, the higher the project risk.

Installation and commissioning costs are affected by:

Modular design that reduces on-site assembly time

Crane layout that minimizes civil foundation complexity

Engineering teams capable of first-time commissioning success

Delayed commissioning often costs far more than the initial equipment price difference.

3. Operating Energy Consumption: A Quiet but Persistent Cost

In regions where electricity prices continue to rise, energy consumption becomes one of the most stable long-term TCO drivers.

Energy efficiency is mainly influenced by:

Motor efficiency and variable frequency drive (VFD) control

Matching of hoisting and traveling mechanisms to actual duty cycles

Whether the crane’s working class truly reflects real operating conditions

Efficient systems, such as properly configured electric hoists used in industrial cranes, can significantly reduce operating costs over time.

👉 See more about industrial lifting systems here:

https://www.slkjcrane.com/electric-hoist/

4. Maintenance and Repair Cost: Projects Are Not “Broken Once,” They Are “Worn Down”

Many overseas projects do not suffer from single major failures, but from frequent minor repairs that accumulate into major operational issues.

Maintenance cost depends on:

Standardization and availability of spare parts

Proven service life of wear components

Local service capability and spare parts supply

Remote diagnostics and technical support availability

Component quality and system integration play a decisive role in long-term reliability.

👉 Learn more about crane components and system reliability:

https://www.slkjcrane.com/crane-part/

5. Downtime Loss and Operational Efficiency: The Highest Risk Cost

In industries such as railways, ports, steel production, and automotive manufacturing:

One hour of crane downtime can disrupt the entire production chain.

Stability, response speed, and control accuracy directly affect:

Output per shift

Overall project timelines

Contract delivery and penalty risks

Low-reliability equipment often results in exponentially amplified losses.

6. Service Life and Residual Value: The Key to Annual Cost Control

A mature industrial crane should offer:

15–20 years of stable operation

Feasibility for upgrades and retrofits

Residual value at the end of service life

The longer the service life, the lower the annualized ownership cost.

Practical TCO Calculation Logic

Crane TCO =

Purchase cost

Installation and commissioning

Energy consumption over service life

Maintenance and repair

Downtime and efficiency loss

− Residual value

Annual operating cost = TCO ÷ actual service years

For project owners, annual cost is the only metric that allows meaningful comparison.

TCO Focus Varies by Industry

Different industries prioritize different TCO factors:

Infrastructure / Railway: stability, delivery time, site adaptability

Ports: continuous operation and efficiency

Shipbuilding: heavy-load capacity and structural reliability

Steel plants: fatigue resistance under high-temperature environments

Automotive: precision, cycle time, automation

Aerospace: safety level and system redundancy

General manufacturing: low maintenance and long-term stability

In these sectors, core lifting systems such as overhead cranes and gantry cranes often determine long-term operational performance.

👉 Explore industrial crane solutions:

https://www.slkjcrane.com/overhead-crane/

https://www.slkjcrane.com/gantry-cranes/

Why Experience Ultimately Determines Crane TCO

TCO is not calculated purely in spreadsheets.

It is determined by engineering capability and real project experience.

With over two decades of industry focus, SLKJCRANE has participated in infrastructure, railway, port, shipbuilding, steel, automotive, aerospace, and industrial projects across multiple regions.

Our understanding is based on one core reality:

Working conditions differ drastically by country

Climate directly affects crane design requirements

There is no universal crane solution suitable for all projects

👉 Learn more about our engineering background:

https://www.slkjcrane.com/about-us/

👉 View real project applications and case studies:

https://www.slkjcrane.com/crane-case/

Conclusion: Calculate First, Decide Later

In the Middle East, Southeast Asia, and Central Asia, a crane is not a one-time purchase—it is a long-term operational asset.

If your project involves infrastructure, ports, shipyards, steel plants, automotive manufacturing, aerospace, or industrial production, calculating crane TCO before equipment selection is essential.

SLKJCRANE is always ready to evaluate your operating conditions and help you understand the true long-term cost, not just the initial price.

Contact Us Now

Have questions about our cranes or need help?

Reach out to our friendly team for expert support and guidance.

We are here to help you power your journey towards a greener future !

Address: Crane Industry Park, Xinxiang City Henan Provice

Frequently Asked Questions (FAQ)

Crane total cost of ownership (TCO) refers to the full lifecycle cost of a crane, not just the purchase price.

It includes the initial equipment cost, installation and commissioning, energy consumption, maintenance and repairs, downtime-related losses, and the residual value at the end of service life.

For industrial and infrastructure projects, TCO provides a more accurate basis for decision-making than upfront price alone.

In most industrial projects, the crane purchase price represents only 30–40% of the total lifecycle cost.

The majority of expenses occur after installation, including energy consumption, routine maintenance, spare parts replacement, and losses caused by unplanned downtime.

This is why a lower purchase price often leads to higher long-term operating costs.

A practical crane TCO calculation typically includes:

Equipment purchase cost

Installation and commissioning expenses

Energy consumption over the operating period

Maintenance and repair costs

Downtime and productivity loss

Minus residual value at retirement

For comparison between different crane solutions, project owners should focus on annualized cost, calculated by dividing total TCO by the actual service life.

The most influential factors affecting crane operating cost include:

Motor efficiency and control system design

Duty class matching with real operating conditions

Quality and availability of spare parts

Maintenance frequency and service accessibility

Stability and reliability during continuous operation

Poor matching between crane design and working conditions is one of the most common reasons for rising operating costs.

Crane downtime can cause significant indirect losses, especially in industries such as ports, steel plants, railway construction, and manufacturing.

Even a short stoppage may disrupt the entire production chain, leading to delayed schedules, reduced output, and potential contract penalties.

From a TCO perspective, downtime-related losses are often more expensive than repair costs themselves.

Yes. Working environment has a major impact on crane TCO.

High temperatures, dust, humidity, or corrosive conditions accelerate component wear and increase maintenance frequency.

Cranes designed specifically for local environmental conditions generally achieve longer service life and lower annual operating costs.

Crane service life directly determines annual cost.

For example, a crane operating reliably for 18–20 years will have a much lower annual ownership cost than a crane requiring major overhauls or replacement after 8–10 years.

Longer service life also improves residual value and reduces capital reinvestment risk.

Crane type (such as overhead crane or gantry crane) is important, but TCO is the higher-level decision factor.

Different crane types can achieve similar lifting functions, but their long-term costs may differ significantly depending on operating conditions, maintenance requirements, and efficiency.

Evaluating TCO helps project owners select the most suitable solution, not just a specific crane model.

Crane TCO should be evaluated before final equipment selection and contract signing.

Early TCO analysis allows project teams to adjust specifications, configurations, and layouts to reduce long-term costs.

Evaluating TCO only after installation often leads to limited options and higher corrective costs.

Experienced crane manufacturers can reduce TCO by:

Designing cranes based on real operating conditions

Optimizing energy efficiency and duty class matching

Using standardized and proven components

Providing technical support, spare parts planning, and service guidance

Engineering experience and project understanding play a decisive role in lowering long-term ownership costs.

Expert in Overhead Crane/Gantry Crane/Jib Crane/Crane Parts Solutions

Eileen Hu

With 20+ years of experience in the Crane Overseas Export Industry, helped 10,000+ customers with their pre-sales questions and concerns, if you have any related needs, please feel free to contact me!

10 Ton Overhead Crane Design Solution for Industrial Workshops

10 Ton Overhead Crane Design Solution: Solving Real Workshop Lifting Challenges Safely and Cost Effectively In modern industrial

How to Calculate Crane Total Cost of Ownership (TCO)

How to Calculate Crane Total Cost of Ownership (TCO) A Practical Decision Guide for Industrial Projects in the

Cranes as the Backbone of Modern Steel Plants

Cranes as the Backbone of Modern Steel Plants How the Right Steel Plant Crane Solutions Drive Efficiency, Safety,

Where Spider Cranes Really Shine: 7 Typical Applications & Real Project Scenarios

Where Spider Cranes Really Shine: 7 Typical Applications & Real Project Scenarios When people ask me about spider